How To Create A Risk Management Plan Using AI in 3 Easy Steps

When I first explored the world of project management, I often wondered how to create a risk management plan. Understanding this concept makes all the difference in how we approach projects, hence, reshaping how my team and I visualize our challenges.

One of the challenges was to develop a project-specific risk management plan which is a strategic document that highlights all possible potential risks a business, project, or initiative encounters and prescribes how identification, assessment, and mitigation of those risks can be effectively done.

With WriteGenic AI, creating a risk management plan has become much easier and more efficient. We can generate a tailored risk management plan within a few clicks.

Statistics have shown that up to 40% of project failures could be prevented by risk management. It, therefore, underlined the undeniable importance of both small and large organizations.

Apart from this, in a recent study, organizations that actively implement structured risk management plans are 50% more likely to achieve their objectives.

This is where WriteGenic AI shines; leveraging the power of advanced artificial intelligence, it streamlines the process reducing the time and effort required to create a risk management plan and managing.

This smart tool will empower you and your team and boost your confidence to tackle uncertainties in the future.

Table of Contents

What is a Risk Management Plan?

Risk Management Plan Definition

A risk management plan is a document that comprehensively identifies potential risks to your organization, together with strategies to mitigate those identified risks. It serves as a roadmap, guiding us through the turbulent waters of project management.

The definition of a basic risk management plan does not emphasize identifying risks but assessing and prioritizing the most critical threats first.

What makes this plan so important is that it is an all-encompassing one. The risks could be financial, operational, strategic, or even compliance-related.

By systematically dealing with such a situation, we can anticipate obstacles and work out a solution beforehand instead of working out solutions when some problem has occurred.

Importance of Creating A Risk Management Plan

Creating a risk management plan is not just a bureaucratic requirement but a key element that makes an organization survive. By articulating and documenting strategies to deal with potential setbacks, we can enhance our decision-making processes and prepare ourselves for future uncertainties.

That’s right, creating a solid risk management framework helps us overcome the fear and increases our resilience against unpredictable events.

From my experience, those teams that believe in the essence of risk management tend to work coherently and always respond to risks more effectively. Besides encouraging an accountability culture, it reassures all our stakeholders and clients that we have their best interests at heart, thus gaining trust and confidence.

Brief Overview on How To Create A Risk Management Plan Using AI

WriteGenic AI makes the intricate development process of “how to create a risk management plan” quite simple. Its advanced features empower us to provide the key data, get certain recommendations, and build a complete plan in a fraction of the time it would have taken otherwise.

Just think of an intelligent assistant that analyzes our project details, past risk exposures, and current market conditions rapidly while keeping us informed and entertained during the process.

Most importantly, WriteGenic AI will continue to learn from our data, providing us with an increasingly better risk assessment and an improved strategy.

Step-by-Step Guide to Generate a Risk Management Plan

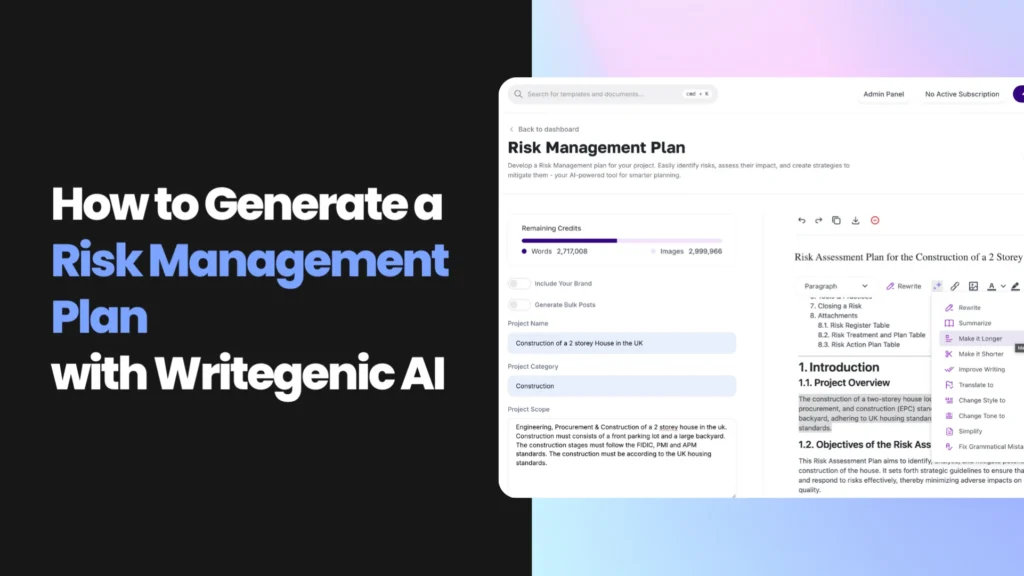

Creating a comprehensive Risk management plan according to your project or business needs, and industrial standards adopted from PMI, APM, and FIDIC is as easy as ABC. Following are the 3 easy steps that get the job done in a few minutes:

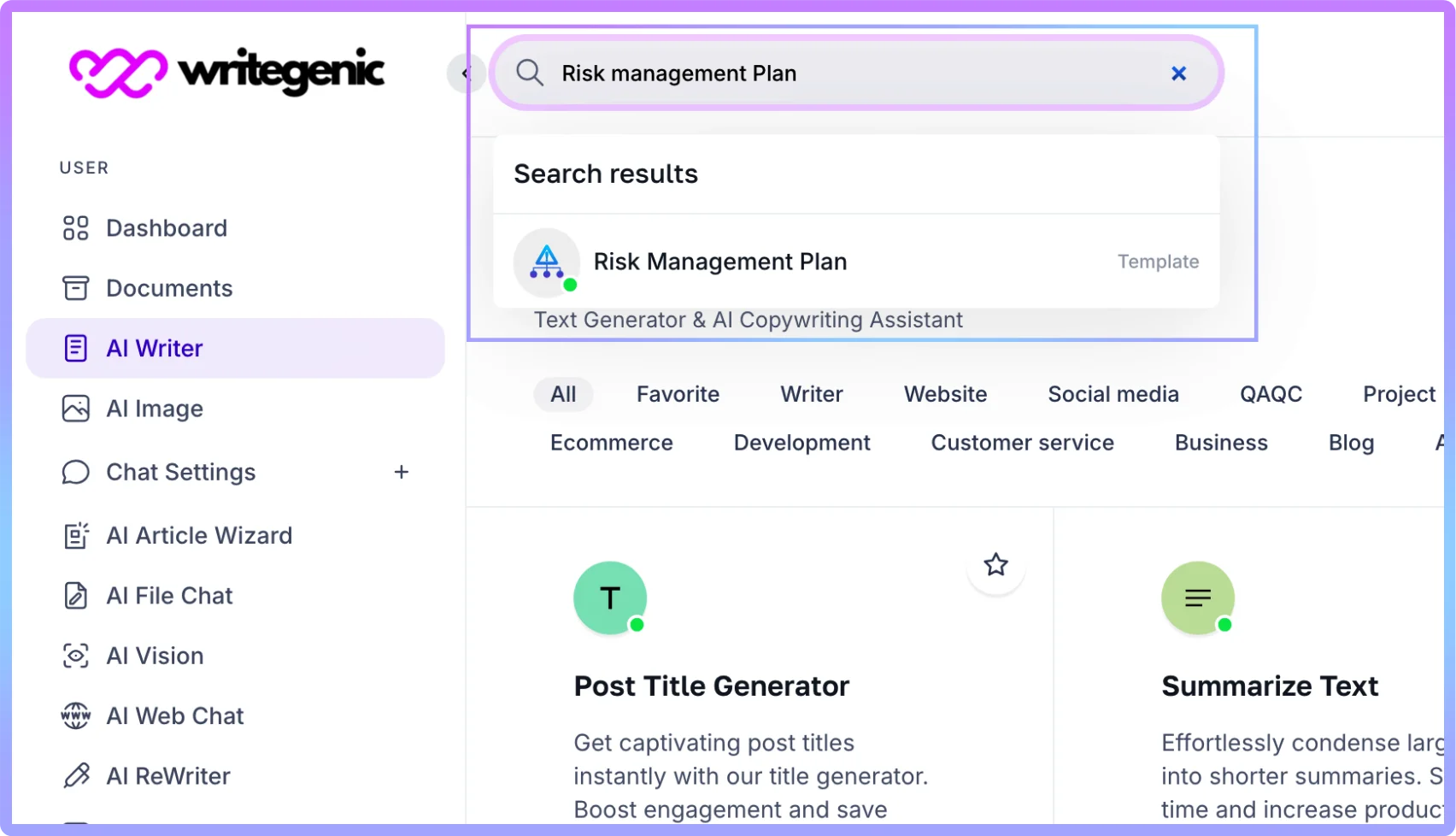

Step 1: Open WriteGenic AI’s Risk Management Plan

- Getting started with the WriteGenic AI is pretty effortless! First, sign in to WriteGenic’s platform and navigate the risk management plan AI Template.

- Once there, the user-friendly layout allows me to start generating my risk management plan. The platform is visually appealing and intuitive, which makes the experience less daunting.

- Well, opening this tool for the first time, I came across several AI templates and AI Tools that took me through. This is an absolute game-changer for those who find risk management plans intimidating!

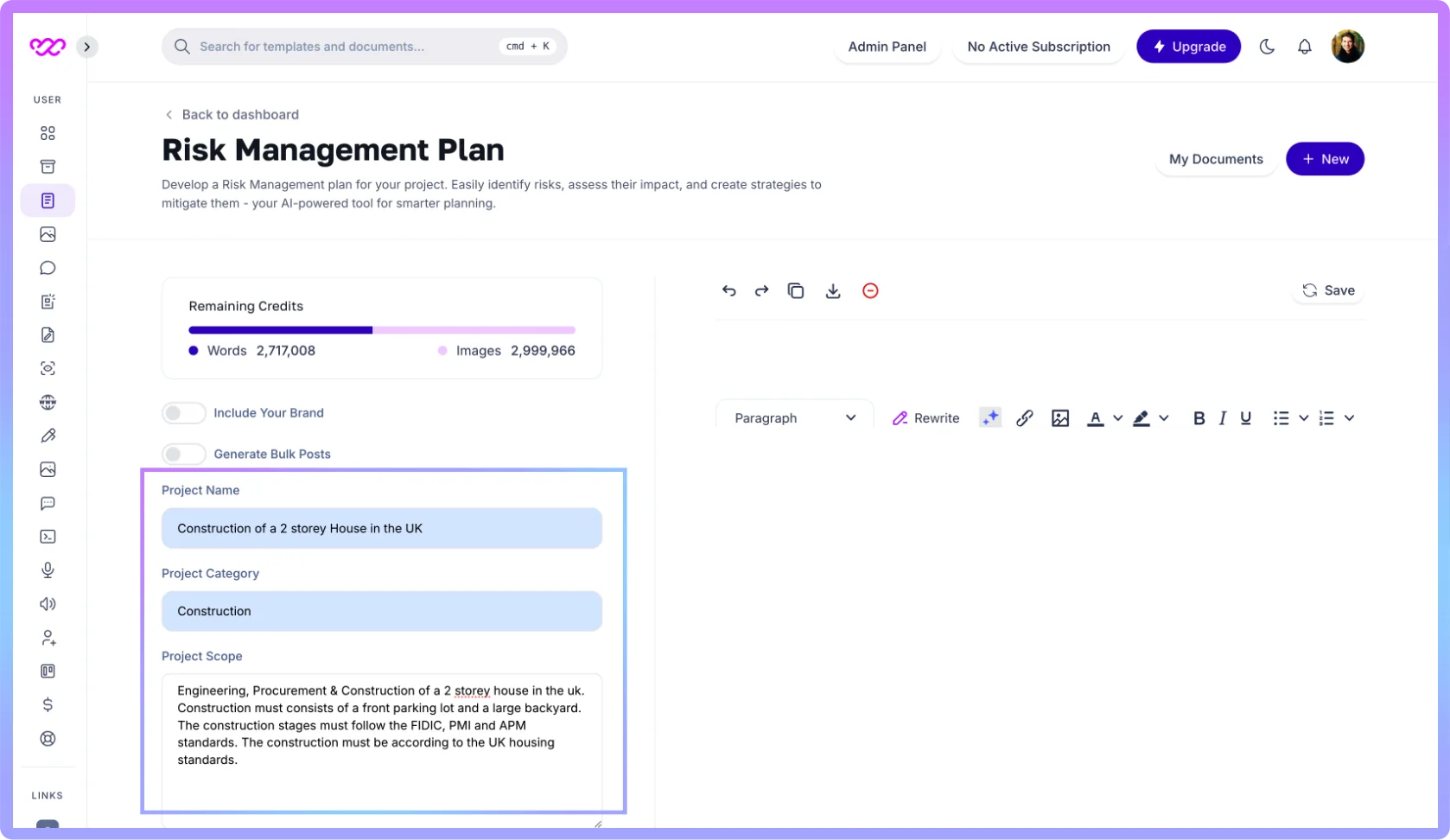

Step 2: Enter The Essential Information

- The next step is to enter the information related to the project or organization. We only have to enter the project name, category, and scope.

- The WriteGenic AI takes us through answering questions that will help us dissect the risks associated with our industry.

- The risk involved is better identified by filling out these inputs. This is an important step, for the quality of information input directly affects the quality of the risk management plan that will be generated.

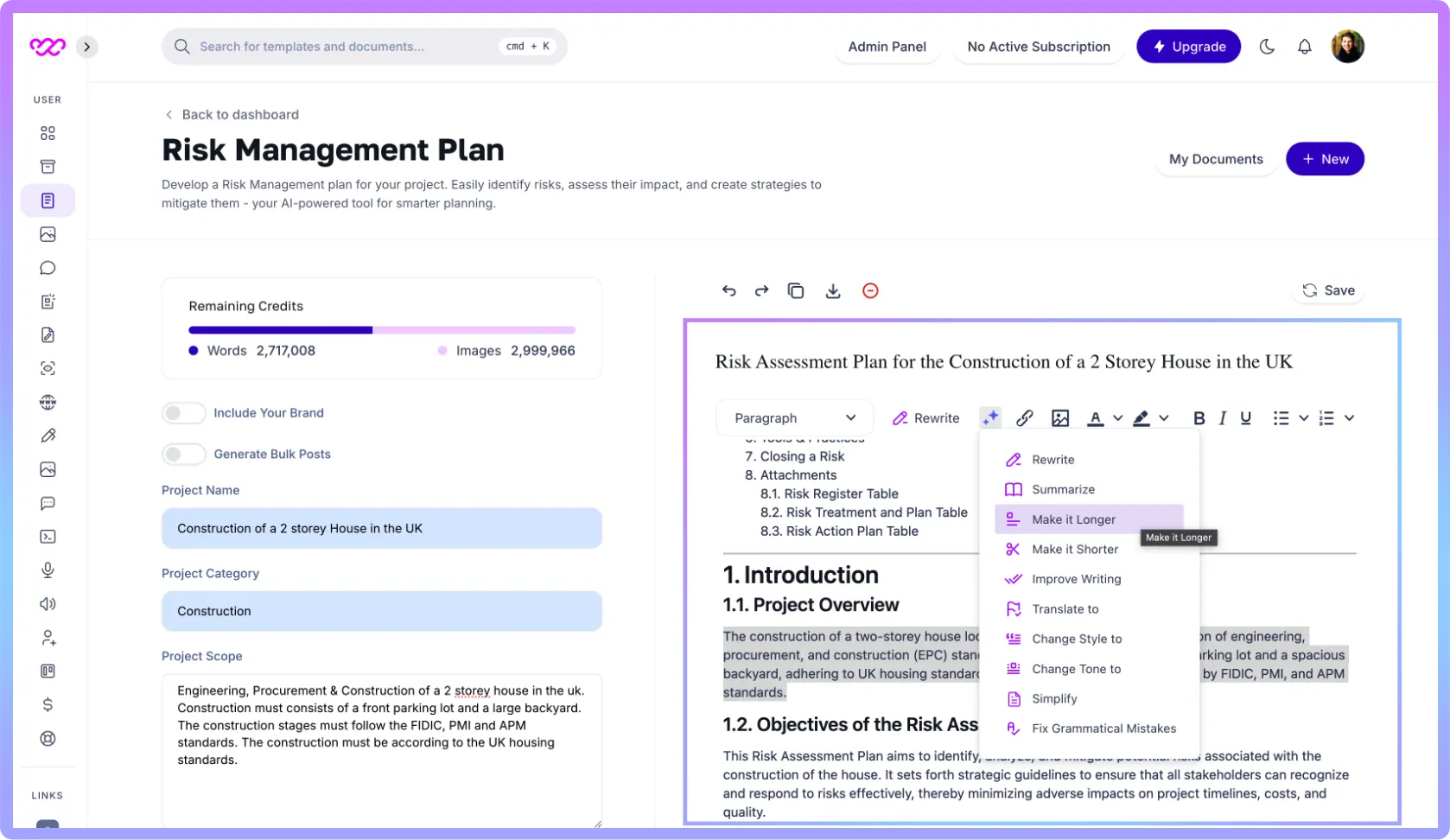

Step 3: Generate the Risk Management Plan

- Finally, when all is set, click the “Generate” button, and there goes a detailed risk management plan.

- WriteGenic AI generates a risk management plan within a few minutes with a priority level and some suggested mitigation strategies that match our project.

- This structured output enables us to develop a deeper understanding of our risks and think through a consistent strategy in the way we will work to mitigate them.

With Writegenic AI,

See it in action!

Understanding The Risk Management Plan Components

1. Risk Identification and Assessment

One of the important risk management plan components is to identify and assess risks are integral parts of any serious enterprise. Risk identification is a complex process that requires systematic brainstorming by the team, along with critical consideration of both external and internal factors.

Some commonly applied techniques are SWOT analysis, PESTLE analysis, and stakeholder interviews.

Once identified, it is important to assess the potential impact and probability of risks; that is where a risk matrix becomes helpful, as it would prompt us to categorize risks on levels of severity.

The objective is to focus on high-probability and high-impact risks, and not to miss low-probability events with high consequences.

Common Risk Identification Techniques:

- SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

- PESTLE Analysis (Political, Economic, Social, Technological, Legal and Environmental)

- Interviews and Surveys with Stakeholders

2. Risk Analysis and Prioritization

After identifying risks, risk analysis and prioritization are next on the list. In an expert’s opinion, this can be one of the most difficult parts of the process, as you make both qualitative and quantitative assessments.

With an in-depth look into the likelihood and potential impacts, the picture becomes much clearer regarding where the focus shall be.

It is in such situations that I would usually refer to risk matrices and heat maps. The reason is that this visualization aids in the prioritization of the risks for me to apply resources and efforts toward the highest threats.

You would not want to spend a great number of hours creating plans for risks that might rarely occur, would you?

Methods for Risk Prioritization:

- Risk Matrix

- Heat Maps

- Decision Trees

3. Risk Response Strategies

Effective risk response strategies should be developed. Different kinds of risks would, by nature, require different approaches even divided into four main strategies, avoidance, transfer, mitigation, or acceptance. Each of these will need consideration and action planning.

For instance, the avoidance may insinuate modification of the project scope. Transferring the risk, on the other hand, can be implied through outsourcing given works to a third party.

This section of planning insinuates that we are proactive, presenting us with things we can do in advance to avoid disaster.

Common Risk Response Strategies:

- Avoidance: Changing plans to sidestep risk.

- Mitigation: Taking steps to reduce impact or likelihood.

- Transfer: Shifting risk to a third party.

- Acceptance: Acknowledging the risk and preparing contingencies.

4. Monitoring and Control Measures

Having strategies is one thing but monitoring and controlling the identified risks is another. This monitoring helps a great deal in continuing to further assess both the existing risks and the emergence of new ones.

Regular reviewing of the risk management plan ensures that it remains relevant and effective.

In my practice, I create an avenue whereby a revisit schedule with my team on the plan would always be availed. This at once fosters a culture of vigilance and adaptability, hence putting us ahead in ways.

Key Monitoring Techniques:

- Regular Risk Reviews

- Key Performance Indicators (KPIs)

- Incident Reporting Systems

4. Documentation and Communication Protocols

We conclude by documenting our findings and ensuring effective communication flow. This is where clear documentation provides not only transparency but allows team members to become more informed on which strategies have been implemented.

Communication protocols allow teams to have organized discussions regarding the risk management process.

By implementing clear lines of communication-scheduled meetings or online dashboards-we make sure that everyone is informed about their role and value added in the risk management process.

Why Use WriteGenic AI for Risk Management Planning?

Following are the key reasons why we use Writegenic AI to create a comprehensive, project-specific, and industry standardized Risk Management Plan:

Introduction to WriteGenic AI and Its Capabilities

Let’s take a closer look at WriteGenic AI. This smart platform optimizes the creation process of the risk management planning exercise. With its intuitive design, powered by strong algorithms, we as users of this intelligent tool can create plans that fit with the essence of our respective organizational needs.

What it essentially does is work like a virtual assistant: it analyzes our data, suggests ways of mitigating those risks, and continuously learns from project experiences. The result is better risk management plans and an insightful approach to managing future uncertainties.

How WriteGenic AI Streamlines the Risk Management Planning Process?

Imagine having to reduce hours of manual risk assessment into minutes. WriteGenic AI streamlines this process through the automation of routine tasks, making it easier for us to spend our energies on critical analysis and high-level discussions.

Using machine learning and AI algorithms will help to quickly scan past performance metrics for determining potential risks from emerging trends. That form of smart insight ensures our risk management plans are informed with current data.

Benefits of Streamlining the process with WriteGenic AI:

- Fast and efficient generation of risk management plans.

- Data-driven insights for better decision-making.

- Continuous learning and updates based on ongoing projects.

Benefits of Using AI in Risk Assessment and Analysis

Integrating AI in our risk management planning provides a lot of advantages. First of all, risk assessments have become much more accurate. Since the WriteGenic AI can analyze large volumes of data, any potential risk is identified at a very early stage.

Moreover, AI integration offers an objective outlook since it reduces human biases in judgment. This advantage of objectivity presents a more transparent environment in which decisions are based on factual data rather than subjective views.

Advantages of AI in Risk Management:

- Increased accuracy and speed in risk assessments.

- Objective data analysis minimizes biases.

- Adaptive learning improves over time.

Case Studies of Successful AI-Assisted Risk Management Plans

The following could be a hypothetical example or case studies of how any manufacturing company or financial services company might have utilized the services of WriteGenic AI:

A manufacturing company used to have high incidences of delays caused by equipment failures. They looked for the help of AI when such incidents became common. Using AI for predictive maintenance and risk analysis resulted in a 30% reduction in equipment downtime.

A case study in financial services revealed that an organization utilized AI to try and identify fraud risk. By analyzing transaction patterns, the system showed deviances that were then able to reduce fraud losses by 25%.

Real-world applications abound and show just how much of a seismic impact AI can make on risk management.

Benefits of Implementing a Robust Risk Management Plan

There are unlimited benefits to creating a risk management plan but a few have been listed below:

1. Enhanced Decision-Making and Strategic Planning

One of the most immediate benefits of developing a risk management plan is improved decision-making and strategic planning. With explicit visibility into potential risks and their impacts, my team and I can make better decisions.

In addition to these, a properly developed plan leads to strategic foresight. Such foresight will create an environment that will enhance proactive planning and resource allocation, therefore minimizing chaos in situations involving crisis management.

2. Improved Resource Allocation and Cost Savings

This will also enable us to formulate a more concise risk management plan, which in turn allows for more efficient resource allocation. When we can perceive what perils may be lying in wait ahead of us, we can distribute scarce resources, money, or personnel where they would be most wanted.

By nipping potential pitfalls in the bud, we are often saving considerable unnecessary costs. Instead of reacting after the fact with costly means-end solutions to deal with crises, strategies are in place to mitigate risks before they can manifest.

Key Takeaways:

- Efficient resource allocation based on risk prioritization.

- Financially beneficial strategies reduce opportunities for loss.

- Completion of projects on budget and on schedule.

3. Increased Stakeholder Confidence and Trust

Risk management carried out transparently elicits confidence from the stakeholders. The trust emanates from our level and frequency of communication and updates regarding our plans, as understood by our teams, clients, and investors.

This further trickles down to the grassroots of the organization and creates an environment where all are secure and willing to speak out on issues concerning risk.

4. Better Preparedness for Potential Crises or Disruptions

The more solid a risk management plan is, the more prepared it makes us not just in strategies but also in resilient mental outlooks. With preparedness, when a real crisis happens, we have things to do to prevent further damage.

What is more, rehearsals and regular simulations will keep our teams ready for actual failures or emergencies, building up their confidence level to respond swiftly and effectively.

5. Compliance with Regulatory Requirements

Lastly, a broad risk management plan helps us to be closer to the requirements set by the regulators.

Most industries demand an acceptable level of standards in risk management; proactive involvement in risk management not only saves us from penalties but also meets the expectations or often exceeds them.

By operating within the boundaries of ethical considerations and regulatory policies, we enhance our brand reputation in the market.

Common Challenges in Risk Management Planning and How to Overcome Them

There are some of the challenges while compiling a Risk Management Plan, but there are always mitigation measures and contingency strategies to overcome it. A few are mentioned below:

1. Identifying All Potential Risks

One of the most persistent challenges in risk management is the identification of all potential risks. It is so easy to ignore small risks, which eventually become major problems sometime later.

To address this challenge, a collective and participative brainstorming exercise is called for. Grouping different stakeholders enables the consideration of a wider scope of risks.

Tips for Identifying Risks:

- Encourage open dialogue across departments.

- Utilize brainstorming sessions with diverse teams.

2. Accurately Assessing Risk Probability and Impact

There are challenges in correctly estimating the probability of occurrence and the potential impact of identified risks. Judgments may get blurred due to biases and assumptions. Improper judgment and decisions on prioritization may take place.

The best way to avoid these pitfalls is through the holistic approach: the combination of quantitative data analysis along with the qualitative assessment of the most important aspects.

Besides that, it may be useful to adopt, for more structured evaluations, supporting tools like the so-called risk matrices.

3. Securing Buy-In from Stakeholders

Getting buy-in from stakeholders sometimes feels like a Herculean task. Resistance to change or other priorities can stall the process of risk management.

In many cases, the early communication of the importance and benefits of a risk management plan helps engage the stakeholders. Data presentation and case studies may also be used to drive home some substantial advantages.

4. Maintaining an up-to-date and Relevant Plan

One of the biggest challenges is keeping the risk management plan current. The environment is constantly changing because of changing market conditions and also changes in project scope; therefore, plans can become outdated in a very short period.

Establishing a schedule for regular review is very crucial so that our plans retain their validity. As we talk, we need to keep the invitation open for input from team members regarding new risks as those are uncovered.

5. Balancing Risk Mitigation with Business Opportunities

Lastly, it is sometimes quite tricky to find the right balance between limiting risks and realizing new opportunities. The clue is in identifying those reasonable risks that may well pay off with high rewards.

Fostering a culture that encourages innovation while managing risk ensures we do not shy away from pursuing beneficial projects.

Frequently Asked Questions (FAQs)

1. How do I get started with WriteGenic AI for risk management?

Simply sign up for WriteGenic AI, access the risk management plan in the AI template, and follow the steps to create your plan.

2. What is the purpose of a risk management plan?

A risk management plan aims to identify risks and develop strategies to minimize impacts on a project or organization.

3. What steps should you take after you complete your risk management plan?

After completing the plan, it’s essential to communicate it to stakeholders and begin the implementation process.

4. Should a risk management plan be updated regularly?

Yes, updating the plan regularly ensures it remains relevant and effective amid changing circumstances.

5. What are the components of a risk management plan?

Key risk management plan components include risk identification and assessment, risk analysis, response strategies, monitoring measures, and documentation.

6. Which risk management plan involves discontinuing an activity that creates a risk?

This is referred to as the avoidance strategy.

7. What are the basic components of a risk management plan?

Basic components include risk assessment and prioritization, risk response strategies, and documentation protocols.

8. What is the risk register in the risk management plan?

The risk register is a document that details, in one location, the several identified risks, their assessment, and developed strategies.

9. How often should risk assessments be conducted?

Risk assessments should be done periodically, especially before major project milestones or organizational changes.

10. Who is responsible for managing risks in a project?

While there may be a designated risk manager, all team members should be engaged in identifying and managing risks. Other roles include: Project Manager, HSE Manager, Planning Engineer, Construction Engineer, Production Manager, etc.

Final Thoughts

Understanding “what is a risk management plan?” and how to generate one effectively is like navigating the unpredictable waters of business.

Using a platform like WriteGenic AI, we take what would be a cumbersome and often hard-to-grasp process of planning risks and turn it into something organized, smooth, and full of insight.

Now we can equip our teams with the foresight to tackle challenges or seize opportunities, placing us a step ahead in an ever-evolving landscape.

Trust us, investing time and resources into a robust risk management plan is not just a safety net—it’s a launchpad for success. So let’s embrace uncertainty, equip ourselves with knowledge of WriteGenic AI, and take proactive steps toward brighter, more manageable futures!

“Also Read the features of Risk Management Plan by Writegenic”